TL;DR: Polymarket’s Shayne Coplan, 27, hits billionaire status after ICE deal.

Bloomberg News reported this week that 27-year-old Polymarket founder Shayne Coplan became the youngest self-made billionaire after the Intercontinental Exchange (ICE) — yes, the parent company of the New York Stock Exchange announced a $2 billion investment valuing his company at roughly $9 billion.

As I read the report, something interesting stood out to me.

First, Polymarket’s big moment came during last year’s U.S. presidential election, when—long before the polls closed—people on the platform were betting that Donald Trump would win. Simply put, they were willing to put their money where their mouth was. Each trade showed what people really believed would happen, and when thousands of those bets added up, it became a kind of real-time forecast, often faster and sometimes more accurate than traditional polls.

But on election night, Coplan found himself in a strange position. While his platform was exploding in popularity, the FBI raided his apartment over allegations that Polymarket had allowed unregistered trading of event-based contracts—essentially, running an unlicensed betting exchange in violation of U.S. securities laws.

Federal agents arrived at 6:00 a.m.

As millions of dollars flowed through his site predicting the outcome of the election, He couldn’t even celebrate that his idea was being proven right as the whole world watched—it was working, but he was under investigation.

So, in less than a year, what change?

As Bloomberg shared, A few years ago, Coplan was broke, selling off his belongings to pay rent. Today, he’s in business with the most powerful network of financiers, technologists, and cultural icons in America. That's what caught my attention- all the key people involved.

So, I have a theory: Making your first $10 million or so is mostly merit. But the next hundred million? That’s a relationships game — who knows you, who trusts you, who reflects power through you.

Your early money comes from what you know — how to code, sell, or spot inefficiency before someone else does. At the start, the market rewards competence — insight, grit, and execution.

But scaling into real wealth comes from who you know — who’ll open doors, make introductions, and give you permission to scale. It’s as if the center of gravity shifts. It’s all about who answers your calls.

Ideas make you money, but people make you matter.

We like to pretend meritocracy scales forever; that the smartest, hardest-working person keeps climbing in a straight line. But past a certain altitude, the air gets thinner, and oxygen starts to come from other people’s lungs.

The modern economy rewards brains to a point, but then it rewards proximity.

And if you want proof, look no further than Shayne Coplan.

How do you go from coding a platform based on an idea in your bathroom, FBI raids, regulatory crackdowns that ban you from operating in your own country, million-dollar fines, to now sitting across from Jeffrey Sprecher, CEO of ICE, negotiating a multi-billion-dollar deal? What changed?

Shayne Coplan, the Bathroom Billionaire

Phase 1: Knowledge Makes You Dangerous

Competence. Product. Execution. That’s where everything starts.

In 2019, Shayne Coplan was broke and furious. He’d dropped out of NYU, was listing his belongings online to make rent, and had grown tired of what he called “crypto grifts.” So he started reading economist Robin Hanson’s papers on prediction markets — a niche idea that few outside academia understood. It basically implied that if you let people express beliefs with wagers, the prices that form are not slogans; they are expectations, hard and accountable. Markets, not manifestos, distill belief.

At any other moment in time, he may have passed over it, but to understand why that reading mattered, you have to see the world as it was then. It was the spring of 2020. Outside, a pandemic shut cities; inside, people stared into screens.

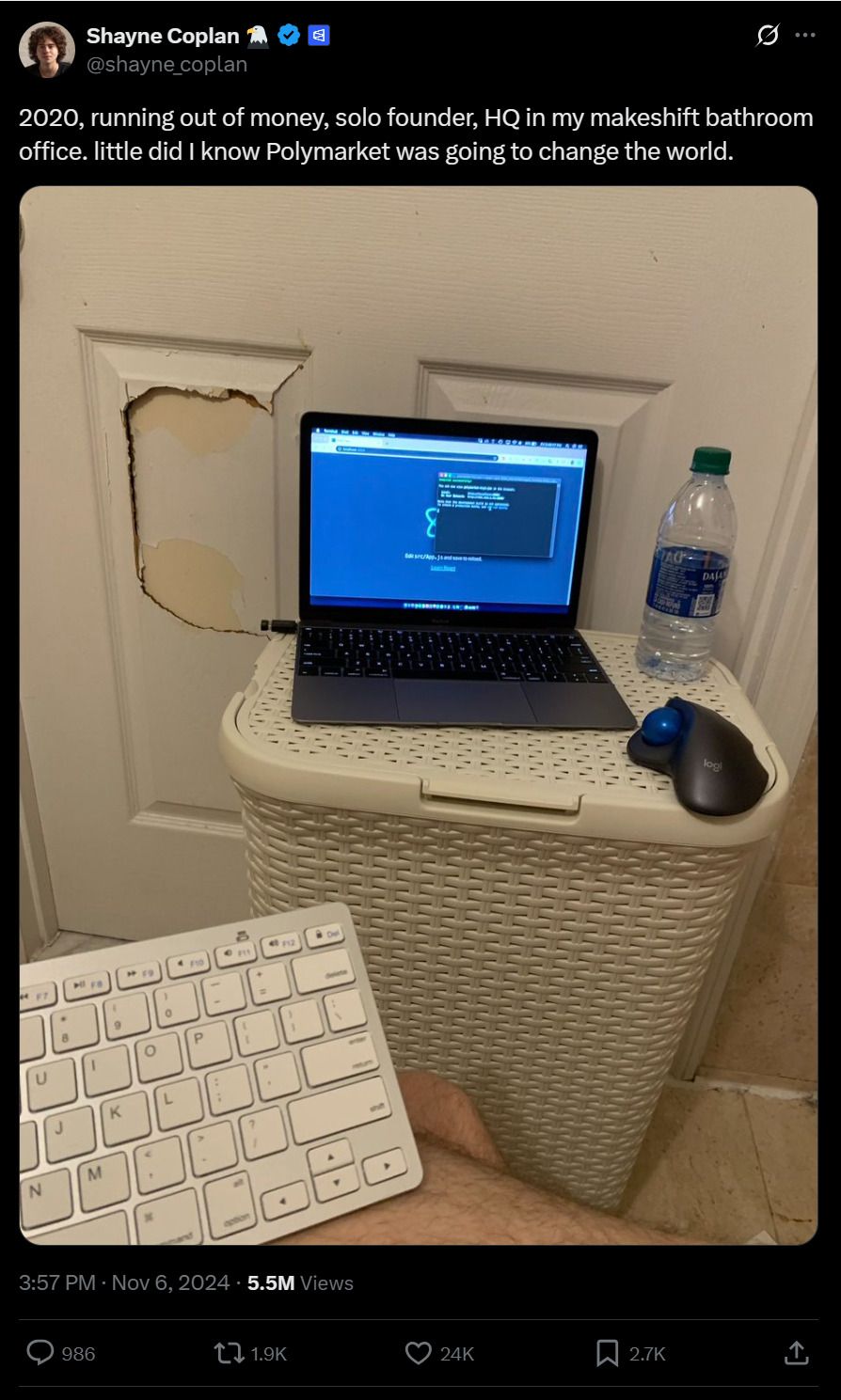

From a cramped bathroom that wasn’t much bigger than a closet in his Lower East Side apartment, he built Polymarket, a platform for betting on real-world events. It launched in June 2020 just as the COVID pandemic was beginning to rear its head.

The mechanics of the platform were simple enough to teach to a stranger but deep enough to reward expertise. If the price of “X will happen” rose from 40 to 60 cents, the crowd was not cheering; it was re-rating reality. The platform’s function was aggregation. It aggregated the wisdom of crowds. You could posture on social media for free. Here, you paid.

To be fair, he didn’t start exactly at zero. That same year, he raised $4 million in seed funding from Polychain Capital, Naval Ravikant, and others. In those first months, the user counts would not impress anyone. Thousands came, not millions. At one point, just around 5,700 people were using it each month.

You can imagine that Coplan spent his days not just writing code but answering tickets, shoring liquidity, fixing the friction no one sees—error states, withdrawals, what happens when the thing that almost never happens happens twice in one day.

But then came the enforcement letter.

On January 3, 2022, the Commodity Futures Trading Commission announced that Polymarket would pay $1.4 million and wind down markets that did not comply with the Commodity Exchange Act.

Reading the order is like walking through a machine room: definitions, authorities, a careful laying out of what had been done and what must now stop.

This is how the American regulatory state speaks when it wishes to be obeyed. (Civil penalty: $1.4 million; cease-and-desist and wind-down.)

CFTC said Polymarket offered the public the opportunity to "bet on your beliefs"

So Coplan stopped allowing American users and recruited compliance veterans, including former CFTC chair J. Christopher Giancarlo, as an adviser to help make the business more legitimate.

Giancarlo didn’t need the job. He’d chaired the CFTC and survived Washington hearings. But when Coplan arrived, Giancarlo later said, “Shayne is a young man in a hurry, but in a hurry to do things properly.” For him to have signed up to help, he must’ve seen a pathway that new rails could be built if you respected the forces that guard the old ones.

If you want to see how much of this phase is knowledge, not yet network, study what changed in the product between 2022 and 2024. There is a kind of craft in writing a market that is both legible to the public and robust under edge cases. There is craft in liquidity incentives that attract order without bribing it; in resolution protocols that survive controversy; in the way you decide what a “source of truth” is when the truth is contested.

These are not dinner-table skills. They are long days with spec sheets and adversarial tests. And for a time, that is what Polymarket was: a laboratory for turning noisy questions into prices.

The big turning point came in late 2023 and 2024, when the U.S. presidential election drew attention to Polymarket. In May 2024, reports surfaced that Peter Thiel (via his fund Founders Fund) publicly became an investor in Polymarket as part of a $45 million round.

With press like that, people started using it much more — trading grew from $54 million in January 2024 to more than $2.6 billion by November, when the user base grew roughly 100-fold. The platform also achieved more public visibility: the Bloomberg terminal had integrated the Polymarket data into its feed, and the platform was praised by public figures, including Nate Silver, the personification of quantified political expectation, who joined as an adviser. That kind of hire does not change a single line of code, and yet changes who is paying attention.

By the morning of November 5th, despite an FBI raid, Coplan was one of the few faces on CNBC - his first TV interview, ever. Polymarket called the election before pollsters, and if you recall, the most esteemed pollsters had the election going another way. It priced a Trump win sooner than the networks called states, forcing anyone who wished to disagree to disagree with money.

Polymarket was now a platform of serious stuff. It had become a public reference.

That is the visible surface. Underneath, the founder’s day was still a set of unglamorous chores. Coplan’s leverage was technical acuity and asymmetric insight. He realized prediction markets could outcompete sports betting if reframed as financial instruments.

That phase — the grind from idea to product-market fit — is pure what you know. It’s about skill density: coding, selling, marketing, fixing, and learning. There are founders whose value is charm; this phase rewards a different skill—competence density—the capacity to learn and fix faster than your own mistakes.

In simple terms: You win early because you notice opportunities others miss. You stay ahead by working deeply across every part of the business. And at this stage, your personal skill and decision-making still drive most of the company’s value; every choice you make compounds growth.

But then something flips. You hit scale. The product works. The market believes you.

The platform’s traction due to the election made it legible to institutions that do not experiment for sport. By the time the ICE investment came, the direction of travel could not be mistaken.

A platform born of an idea on how the public prices the future was being invited to plug into the main grid.

Everything After Is Who You Know

Shayne Coplan rings the NYSE bell with Jeff Sprecher, Mark Shapiro, Dana White, Ariel Emanuel, and Lynn Martin.

Phase 2: Network Is the Multiplier

Once you achieve product-market fit, the limiting factor is no longer product. It’s access.

To be fair, Copeland didn’t just start networking. If you look at his pattern, when in 2022 Polymarket had to pay a $1.4M fine for offering unregistered trading services, He built legitimacy by hiring insiders, partnering with trusted data providers, and aligning with credible investors. It helped the markets believe the valuation. Each move was a signal to regulators and institutions: this company is real, compliant, and here to stay.

Coplan understood that product traction is necessary but not sufficient in regulated, public-minded spaces. He was building trust, as that was more important than his codebase.

Because let’s be clear, Polymarket isn’t the only platform of its kind. But it is the anointed one, and that’s the difference.

When Bloomberg’s Billionaires Index dubbed Coplan the youngest self-made billionaire, it wasn’t only a measure of capital, but trust and permission. Polymarket was being given the right to operate at scale without being shut down.

Once you get to a certain point, the bottleneck isn’t your idea. Instead, it’s access. You stop competing on “what you know” and start competing on who trusts you enough to bet on it.

If you listen to Coplan on CNBC, you would be seriously impressed at how competent, confident, and likable he is. If this emerging industry needed a poster person, it was him, and he didn’t wear a suit and tie.

Copland says ICE's invesment could legitimize prediction markets.

Look at the Polymarket deal again: Coplan’s pivot from outsider to insider wasn’t technical. It was relational. ICE didn’t invest in an algorithm; they invested in a human bridge between Wall Street and the next generation of financial markets.

That’s the invisible transition every successful founder faces. You go from knowing things to knowing people who know things. Once the product works and traction exists, marginal growth depends less on skill and more on access to capital, distribution, and influence. You stop optimizing code or ads and start managing relationships that multiply reach.

Suddenly, introductions are worth more. You start attending dinners, and might even start wearing suits and gowns. The most important skill becomes proximity to power.

Coplan and Sprecher at SEC-CFTC joint roundtable.

For Coplan, he learned that to enter those rooms, he’d have to listen more and speak less. His hoodie gave way to a blazer for the price of a bit more legitimacy.

Polymarket’s turnaround — from FBI raids to an $9B valuation — didn’t happen through product tweaks, but through Coplan’s ability to build alignment with ICE, Trump-linked funds, and regulatory insiders. That’s not about what he knows anymore. It’s who’s willing to pick up the phone for him.

The three things that matter are having smart investors who believe in you, building trust that opens new doors, and earning a reputation strong enough that people no longer ask if you can build — they ask if they can trust you to lead at scale. You’re no longer in the business of proving competence; you’re in the business of managing confidence.

You become the ‘Opportunity’

Phase 3: Influence & Trust are the Moat

Now everyone wants to know Shayne Coplan. What pushed Polymarket from niche bathroom startup to headline-making powerhouse is its web of connections.

Silicon Valley, Hollywood, Sports, Politics - they're all there.

Seriously, look at this list of investors Coplan thanked after the announcement:

Founders Fund (Peter Thiel)

Ribbit Capital, Valor Ventures, Point72 Ventures, SV Angel,

1789 Capital, by Donald Trump Jr., who later joined Polymarket as an adviser.

1confirmation, Blockchain Cap, Coinbase Vent., Dragonfly, Abstract, ParaFi

Angel investors: Ari Emanuel, Chase Lochmiller, Glenn Dubin, Gaurav Ahuja, Guy Oseary, Naval Ravikant, Rick Rubin, Ron Conway, Tom Dundon, Travis Kalanick, Anthony Kiedis, Diego Berdakin, Dylan Field, Mark Pincus, and even NFL star Saquon Barkley

That’s a social graph that touches Silicon Valley, Wall Street, Hollywood, and Capitol Hill. These are structural relationships providing regulatory softening, legitimacy, institutional distribution, media access, and influence. At this level, the network becomes the plumbing.

The ICE investment is most interesting because one of the most important details is that Jeffrey Sprecher’s wife is Kelly Loeffler. That’s right, she heads the Small Business Administration and sits in Donald Trump’s cabinet.

Loeffler with husband Jeff Sprecher. She previously oversaw the CFTC, but stepped down due to a conflict of interest.

You can’t get a more ‘establishment’ endorsement than that. Polymarket isn’t a startup anymore. Rather, think of it as a syndicate. Coplan built a bridge into that establishment, going from rebel coder to the guy the NYSE cuts checks to.

That’s not “who you know.” That’s who can’t afford not to know you.

At this stage, product quality still matters, but what matters more is alignment. Insulation. Influence. Who will risk their reputation for you? Who can help you navigate policy, perception, and power?

Coplan is entering this stage now. He is the center of gravity, and ICE’s $2 billion check, for what it offers, can’t afford to exist outside that orbit.

Now, Coplan is preparing for re-entry into U.S. markets. He acquired QCEX, a regulated derivatives exchange and clearinghouse in Florida, for $112 million, effectively purchasing a bridge into compliance. The man fined for operating without a license now owns one.

The 'Problem', if you will, with “Networking.”

"The illusion of progress is not progress.”

After a certain point, the product doesn’t need to be 10x better. You do.

Distribution becomes about contact.

The right investor opens 50 doors you can’t brute-force with ads.

The right adviser (say, a Trump Jr.) buys you regulatory tolerance.

The right institutional partner (ICE, NYSE) makes the market treat you as inevitable.

But to get to that point, it’s worth assessing what you want. If you’re still in the first phase, you don’t need a room full of people handing out business cards. You need a quiet room, a whiteboard, and time.

The truth is merciless. The ROI on intros is near zero when your product or what you’re offering isn’t indispensable. But once you hit scale, the math flips. To get to the next phase, your next marginal dollar comes from conversations.

The right partner, the right investor, the right adviser—these are multipliers, not engines. They amplify what exists; they cannot conjure what doesn’t.

Sam Altman even said something similar once:

Look at the date. In Dec 2015, Altman co-founded OpenAI.

Most people get this backward.

If what you’re working on isn’t ready or there’s a market misfit, a network won’t bail you out. Many highly funded companies fail because they lack discipline, domain mastery, or robustness. The network can amplify, but it can also expose.

They show up to conferences and chase introductions before they build anything worth introducing.

A network without a foundation of competence is like scaffolding around an empty lot. It looks impressive until the wind picks up.

The founders who go network-first flame out fast. They spend more time “being in the room” than building something that earns them a seat at the table. They’ve spent their credibility before they’ve earned it.

The best network strategy in the world can’t fix a bad product, an unprepared mind, or a hollow reputation. You can’t handshake your way to product-market fit or influence. People who chase introductions and prestige without having anything to offer that stands up to the test end up hollow: they float on promise but collapse under scrutiny.

You know people in your industry who whose first move is spinning LinkedIn posts, getting on speaker panels, joining incubators, but with little in the way of technical grounding. They may attract attention early, but often burn out or collapse when real execution begins.

The risks of over-networking too early are many:

You generate hype but no substance. When people dig, they find nothing. Reputation crumbles.

You become a “surface brand” — lots of contacts, few deliverables. Your network becomes parasitic rather than symbiotic.

Your leverage is weak: a network without a foundation is shallow. If your product or service fails, nobody stands by you.

You risk overextending relational capital: you burn goodwill by overpromising.

The risk of reversing the order is fragility: when your network fades, you have nothing to support you. If the product or competence isn’t real, the network is built on sand.

Does that mean don't go to conferences?

It depends on what you’re optimizing for. You need a skill no one can fake. For most people, the immediate playbook should be this:

Focus energy on craft, specialization, and domain mastery.

Get really good at a few things.

Build something real: a product, a thesis, a set of users, and an audience.

Don’t over-invest in “networking” as spectacle. Go deep in one or two ecosystems.

Find a few mentors or investors who believe in you early — not a flood of weak links.

Use the “be helpful first” principle: find small ways to contribute, gain credibility.

It’s not all booksmart, either.

The inverse is also true. The “book-smart” meritocracy crowd has its own blind spot: thinking talent alone wins. Merit doesn’t always win. There are plenty of brilliant people with billion-dollar ideas who never leave the launchpad. The solitary technician who believes talent alone is justice, who sits in a room forever polishing perfection, will watch lesser craftsmen climb past him.

Why? Because talent without access dies in isolation. Regulators, financiers, and institutions don’t care about IQ points. They care about risk reduction. At scale, your network becomes the proxy for trust.

The line is narrow. First, the discipline to build what lasts; then the wisdom to let others carry it farther. Your first million(s) are built on insight, execution, and domain mastery. It’s a linear type of income. You earn them through labor, cleverness, and iteration.

But tens or hundreds of millions require that others invest in you with capital, reputation, and power. It’s relational and exponential.

Shayne Coplan has built in that order.

So What’s the Playbook?

The people who rise highest understand both sides of the equation. They master something rare and then make sure the right people know they did.

Shayne Coplan built a power station of a product, and then he built a network of powerbrokers.

His early wealth came from knowledge. If he has enduring wealth, it will come from alignment — a web of investors, artists, founders, and power brokers who bet on him because they can’t afford not to.

So if you’re building, build. If you’re scaling, connect. And if you’re confused, remember this:

Ideas make you money, but people make you matter.