TL;DR: We used to call it a side hustle. Now, it's just work.

/Here’s what changed.

A second paycheck has become the safety net that the first one no longer provides.

One full-time job used to cover the basics: rent, food, transport, and a little savings. Now fixed costs rise faster than many wages. Credit cards charge rates that punish any slip. Rents jump at renewal. Student loans restart. A car repair or a medical bill can knock a month off balance. Families can’t count on steady hours either; schedules shift, bonuses vanish, and overtime comes and goes. So people build their own cushion by working a second job.

Is a second job now a necessity?

The second job takes many shapes. Some drive in the evenings. Some teach online, shop for groceries, or deliver meals. Some work weekend shifts at a warehouse or a hotel. Others freelance—design, coding, bookkeeping, photography—stacked on top of a day job.

For a long time, the deal was simple: one employer, one income, one set of benefits. That deal has faded.

The label doesn’t matter, but the pattern does: one paycheck covers the base; the second covers the gaps and the shocks. We still use old words—“gig,” “contract,” “side”—as if this were temporary. It isn’t.

It's no longer about “Who has a second job?” It is “Who would sink without one?”

The Numbers Don't Lie

Recent data from the Bureau of Labor Statistics shows multiple jobholding running around 5.2 – 5.4 percent of employed Americans. That’s a meaningful share of the workforce juggling two or more jobs just to keep things together.

The government calls these workers “multiple jobholders.” They call themselves what they are: people trying not to drown.

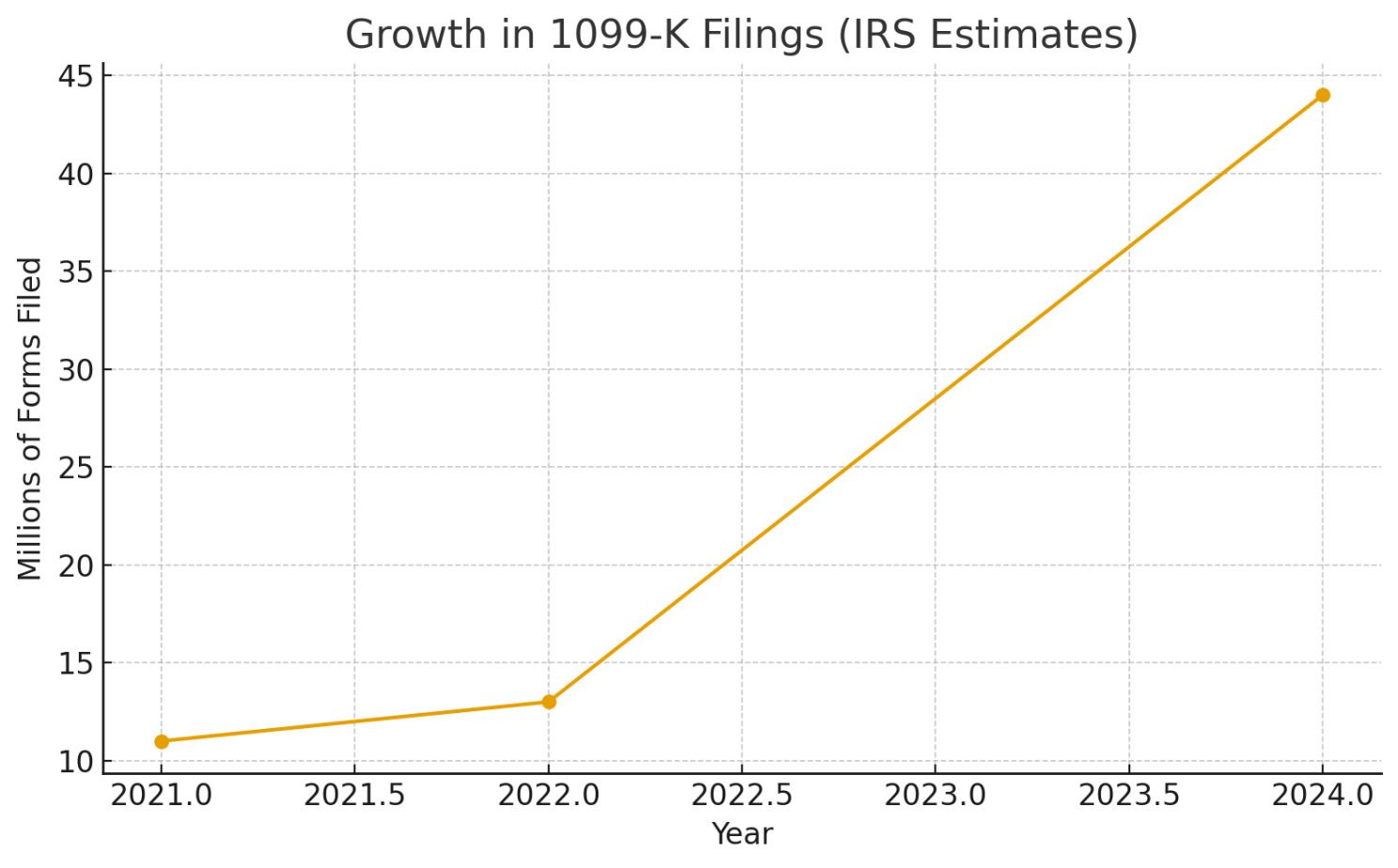

IRS and tax-reporting trends hint at a larger picture. Filings of 1099 forms (for independent-contract income) have swelled in recent years, and new rules are pushing even more informal work fully into the IRS’s line of sight.

The steep rise is due to new IRS reporting rules for payment platforms like Venmo which capture more side-income data.

The discrepancy lies in how we count “working multiple jobs.” The BLS only counts those reporting more than one job in its survey, which misses part-time gigs or side income below thresholds. Meanwhile, the IRS sees gross payments reported via 1099 or 1099-K even when those same workers don’t self-identify as holding a “second job.” That's up more than 40% since 2019.

The result: tax data suggests more people are earning from side work than labor surveys imply, because some gaps are filled by informal hours, micro-gigs, or under-the-radar income.

The IRS now estimates the number of 1099-K forms sent in 2024 will hit 44 million—nearly triple its earlier projection of 16 million. Before that, the IRS reported 11 million 1099-K forms in 2021, rising to nearly 13 million in 2022. The shift stems partly from lowered thresholds for reporting payments, which drew much more side work into official reporting.

This gap explains why IRS tax data shows a faster rise in multiple-income earners than the Bureau of Labor Statistics (the 5 percent of workers as “multiple jobholders”). The 1099 system reflects hidden labor — people who don’t think of themselves as having a “second job” but do, in fact, depend on it.

More than 4.8 million Americans have a part-time job in addition to their full-time roles.

Since 2020, earnings from platform work have jumped. More than 70% by some counts. Wages in old-line sectors did not keep pace. Uber, DoorDash, and Fiverr used to be the edge, but now they are the pressure valve.

We all know these people:

'Maria', retail + driving. Stocking at dawn pays the rent. Driving after dinner pays the card bill and the co-pay. No driving this week? The card balance grows.

'Jamal', security + freelance IT. Overnight security gives him health insurance. Weekend IT gigs pay down a 22% APR card and keep his car running so he can reach both jobs.

'Carla', office admin + weekend service. Her weekday job is steady but capped. Saturday catering covers groceries when prices jump and saves a little for emergencies.

None of them is chasing a dream. They are buying stability in small pieces.

Why the “side” matters so much now:

Lumpy Cash. Paychecks come on time; life doesn’t. A second job smooths bumps.

Debt is expensive. At high interest, a balance is a slow leak. Extra income plugs it.

Hours are fragile. If one employer cuts shifts, the second job keeps the lights on.

Prices don’t wait. Groceries, rent, don’t pause for performance reviews.

People learn to manage time like money. They work when rates surge on apps. They accept overtime when it’s offered and swap shifts to protect sleep. They pick one or two platforms and master the incentives instead of chasing five and burning out. They set aside a little for taxes on every 1099 dollar, so April isn’t a cliff. They attack the highest-interest debt first because it’s the fastest way to free up cash.

The lemonade stand came back with an LLC and burnout.

It’s simple math. The second job is insurance that you can actually get today. You don’t fill out a form. You open an app, take a shift, book a client, or say yes to Saturday.

There is a cultural piece, too. We’ve glamorized the grind and ignored the risk. “Be your own boss” sounds bold until you are also your own HR, your own benefits office, and your own backstop. Still, people do it because the alternative—waiting for the old deal to return—doesn’t pay the rent.

The “Side” Job Is Now the "Spine" of the economy

The new middle class runs like a small business.

Dawn comes. Screens light up. A car turns over in a cold driveway. A delivery bag gets zipped. The country hums. Maria’s dashboard glows orange. Another fare. Another mile. No soundtrack. No speech. Just the work. For a growing share of the middle class, the second job isn’t optional.

We keep calling this a side hustle. It isn’t. It is the scaffolding holding up a system that forgot how to build ladders. It is the spine that holds the month together. Take it away, and the budget collapses. Keep it, and the family can handle a surprise bill, a short paycheck, or a bad week without breaking.

Bottom line: W-2 by day. 1099 by night. LLC by necessity.